An Overview of Technology and Innovation in Las Vegas

-

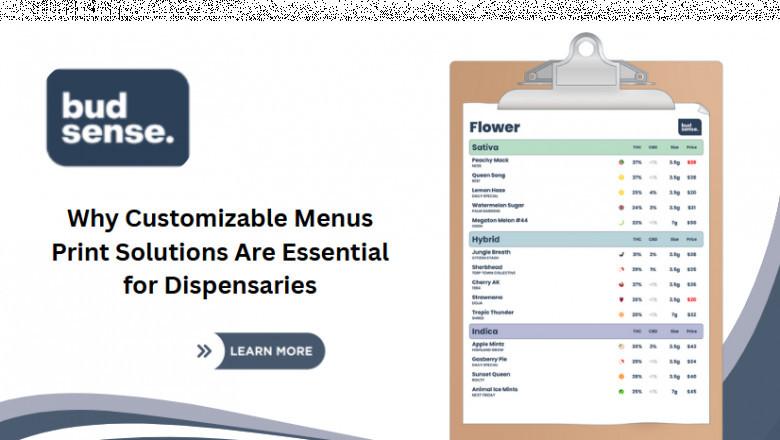

BudSense offers customizable menus print tools for cannabis retailers. Crea...

Dakota Hemp’s CBD Hemp Oil offers natural stress relief, pain support &...

Unleashing Creativity: Themed Face Paint Ideas for Kids’ Parties

Sécurité des données sur les sites de paris sportifs : un enjeu capital

Agency’s main objective is to create a storyline captivity enough to hook u...

Comment bien gérer son budget dans les paris sportifs pour maximiser ses ga...

One of the most immediate psychological benefits of a Mommy Makeover in Dub...

Discover why custom foam inserts are crucial for protecting products during...