views

Polybutadiene Rubber Market Value Set to Cross USD 13.73 Billion 2025-2032

Market Size & Growth

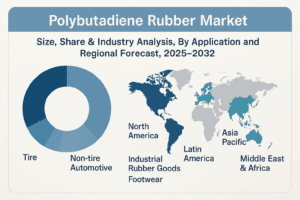

According to Fortune Business Insights, The global polybutadiene rubber market size was valued at USD 9.41 billion in 2024. The market is projected to grow from USD 9.86 billion in 2025 to USD 13.73 billion by 2032, exhibiting a CAGR of 4.8% during the forecast period.

Polybutadiene rubber (PBR), also referred to as butadiene rubber (BR), is a type of synthetic rubber made by polymerizing 1,3-butadiene, a petroleum-based monomer. Classified as an elastomer, it is known for its high resilience, superior abrasion resistance, low glass transition temperature, and remarkable elasticity, enabling it to regain its original shape after being stretched or compressed.

What is Polybutadiene Rubber?

Polybutadiene (BR) is a synthetic elastomer created by polymerizing 1,3‑butadiene. It’s prized for its high resilience, abrasion resistance, low glass transition temperature, and ability to rebound after deformation. Primarily used in high‑performance applications, approximately 70% of PBR is consumed in tire production, while the rest serves as an additive in plastics, golf balls, footwear, and more.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/polybutadiene-rubber-market-113414

LIST OF KEY POLYBUTADIENE RUBBER COMPANIES PROFILED

- ARLANXEO (Netherlands)

- Indian Oil Corporation Ltd (India)

- Reliance Industries Limited (India)

- ENEOS Materials Corporation (Japan)

- Goodyear Tire and Rubber Company (U.S.)

- SIBUR International GmbH (Austria)

- LANXESS (Germany)

- KURARAY CO., LTD. (Japan)

- JSR Corporation (Japan)

- Kumho Petrochemical (South Korea)

Key Market Drivers

1. 🚗 Automotive & Tire Manufacturing

-

Superior properties such as low rolling resistance and abrasion resistance favor PBR for tire treads and sidewalls.

-

With global automotive output climbing, so does the demand for PBR.

2. Infrastructure & Construction Boom

-

PBR’s flexibility, durability, and weather resistance make it ideal for infrastructure projects like conveyor systems and expansion joints.

Market Trends & Opportunities

🌿 Sustainability Push

-

A growing preference for eco-friendly materials is driving manufacturers to develop bio-based PBR and expand recycling capabilities.

🏃 Expanded Use in Consumer Goods

-

PBR is increasingly used in footwear (soles), sports equipment, and consumer industrial goods due to its performance benefits.

Challenges Facing the Market

-

Health Concerns

-

Exposure to PBR may irritate the eyes, respiratory tracts, and cause neurological symptoms at high levels, prompting stricter workplace regulations.

-

-

Environmental Regulations & Production Costs

-

Emissions, hazardous waste, and mandated clean production are raising compliance costs and entry barriers.

-

-

Trade Protectionism

-

Tariffs and import restrictions may inflate costs and disrupt supply chains.

-

Segmentation Breakdown

| Segment | Market Role |

|---|---|

| Tire | Dominating segment due to abrasion resistance and durability |

| Non-Tire Automotive | Used in seals, gaskets, and flexible vehicle components |

| Industrial & Footwear | Utilized for soles, industrial goods, and equipment components |

| Others | Includes golf balls, hoses, plastic additives, industrial pads |

- Asia Pacific leads the market, holding over half of global volume (~USD 5.04 billion in 2024), driven by growth in China, India, and Japan.

- North America benefits from a strong automotive and industrial base, though environmental compliance adds pressure.

- Europe is focusing on sustainable production with moderate growth.

- Latin America, Middle East & Africa are emerging markets with infrastructure-led opportunities and slower economic momentum.

Notable developments:

- Arlanxeo launched a 65 ktpa PBR plant in Brazil (Feb 2023).

- Indian Oil planned a 60 ktpa PBR plant in Panipat, India (Mar 2022).

- SIBUR upgraded its Voronezh Nd-BR plant to enhance efficiency (Feb 2019).

- Global synthetic rubber demand

Strategic Insights

- For Investors: The projected growth and shift to green polymers make PBR production and recycling ventures attractive.

- For Manufacturers: Specializing in bio-based and recycled PBR, while prioritizing emissions control, opens new markets.

- For End-Users: Automotive OEMs benefit from PBR’s performance, especially in sustainable and fuel-efficient vehicle production.

The Polybutadiene Rubber market is poised for robust growth driven by rising automotive production, infrastructure expansion, and sustainability initiatives. Despite environmental and regulatory challenges, innovation in bio-based materials and strategic expansion by major players will shape the industry’s future across global markets.

Information Source: https://www.fortunebusinessinsights.com/polybutadiene-rubber-market-113414

KEY INDUSTRY DEVELOPMENTS

-

February 2023: Arlanxeo announced the launch of a polybutadiene rubber production facility with a capacity of 65 ktpa in southern Brazil. Located within the Triunfo petrochemical complex in Rio Grande do Sul, this new plant emphasizes the company's commitment to enhancing its presence in Latin America.

-

March 2022: Indian Oil Corporation Limited planned to build a 60 ktpa polybutadiene rubber (PBR) facility at the current naphtha cracker complex located in Panipat. The project involves an investment of INR 14.6 billion (USD 169 million). It plans to obtain the necessary feedstock, butadiene, from the 138 ktpa butadiene extraction unit (BDEU) already operating within the Panipat complex.

Comments

0 comment