views

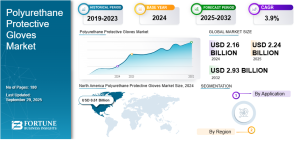

Polyurethane Protective Gloves Market Emerging Trends and Growth Forecast 2032

According to Fortune Business Insights, The global polyurethane protective gloves market size was valued at USD 2.16 billion in 2024. The market is projected to grow from USD 2.24 billion in 2025 to USD 2.93 billion by 2032, exhibiting a CAGR of 3.9% during the forecast period. North America dominated the polyurethane protective gloves market with a market share of 23.61% in 2024.

Polyurethane protective gloves are specialized hand-protection gear coated with a thin layer of polyurethane (PU) on a fabric liner. These gloves combine flexibility, grip, and comfort, making them ideal for tasks that require precision and dexterity. Unlike heavier gloves, PU gloves are lightweight, breathable, and provide a “second-skin” feel, suitable for industries such as manufacturing, automotive, electronics, and food processing.

Key Market Players

Prominent companies operating in the polyurethane protective gloves market include:

- ANSELL LTD. (Australia)

- PIP Global (U.S.)

- Radians, Inc. (U.S.)

- Global Glove and Safety Manufacturing, Inc. (U.S.)

- Engelbert Strauss Inc. (Germany)

- HANVO Safety (China)

- NANTONG JIADELI SAFETY PRODUCTS CO., LTD. (China)

- Tilsatec (U.K.)

- Kimberly-Clark Worldwide, Inc. (U.S.)

- HexArmor (U.S.)

These companies focus on product innovation, material enhancement, and regional expansion to maintain competitiveness.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/polyurethane-protective-gloves-market-113851

Key Drivers of Growth

-

Stringent Safety Regulations

Rising awareness of worker safety and stricter industrial regulations are major factors driving the demand for high-quality protective gloves. PU gloves meet essential safety standards for abrasion resistance, mechanical protection, and durability. -

Demand for Dexterity & Precision

Sectors like electronics assembly, inspection, and fine mechanical work require gloves that provide excellent tactile sensitivity. PU coatings are thin and flexible, offering enhanced finger movement and control. -

Comfort & Ergonomics

PU gloves are lightweight and breathable, reducing hand fatigue during long hours of use. Their ergonomic design ensures comfort and better performance in repetitive or delicate tasks. -

Expansion of End-Use Industries

The growing industrial sectors—automotive, construction, food processing, and healthcare—are fueling the adoption of polyurethane gloves. In electronics manufacturing, in particular, these gloves are preferred for precise handling. -

Product Innovation

Manufacturers are developing advanced PU gloves with cut resistance, touchscreen compatibility, and improved grip in oily or wet conditions. These innovations enhance usability and expand application scope.

Challenges & Restraints

-

Price Sensitivity: PU gloves are typically more expensive than vinyl or latex gloves, which can deter adoption in cost-conscious markets.

-

Chemical & Heat Resistance: PU coatings have limited resistance to extreme heat and certain chemicals, reducing their use in specific heavy-duty applications.

-

Durability Issues: In highly abrasive or solvent-heavy environments, PU gloves may wear out faster, leading to higher replacement rates.

-

Competition from Substitutes: Materials like nitrile and neoprene provide strong competition, especially where higher chemical resistance is needed.

Market Segmentation

| Segment | Description |

|---|---|

| By End-Use Industry | Automotive, Construction, Healthcare, Food & Beverage, Electronics, Logistics, and Others |

| By Product Type | Disposable, Reusable, Cut-Resistant, Work Gloves, and Light Assembly Gloves |

| By Coating Type | Palm Coated, Fingertip Coated, Smooth Finish, and Textured Finish |

| By Thickness / Gauge | Thin (<5 mils), Medium (5–8 mils), Heavy (>8 mils) |

| By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Regional Insights

-

North America held a significant share in 2024 due to strong occupational safety standards and established industrial sectors.

-

Asia-Pacific is expected to witness the fastest growth, driven by rapid industrialization, expanding electronics and automotive industries, and increased focus on workplace safety.

-

Europe continues to grow steadily, supported by strict safety compliance standards and widespread adoption of advanced PPE technologies.

Emerging Trends

-

Touchscreen-Compatible Gloves: The integration of touchscreen technology into industrial gloves enables workers to operate smart devices without removing protection.

-

Eco-Friendly Manufacturing: Companies are investing in sustainable materials and low-VOC polyurethane coatings to minimize environmental impact.

-

Improved Ergonomic Designs: New glove designs focus on lightweight construction, ventilation, and flexibility for maximum comfort.

-

Specialized Applications: Demand is rising for gloves tailored to high-risk applications, including extreme cut or impact resistance.

Information Source: https://www.fortunebusinessinsights.com/polyurethane-protective-gloves-market-113851

Market Outlook & Opportunities

The polyurethane protective gloves market is poised for consistent growth over the next decade. The greatest opportunities lie in medium-risk work environments that require dexterity and comfort rather than bulk protection. Emerging economies are also increasing their adoption of industrial safety equipment as regulatory frameworks strengthen. Additionally, sectors like healthcare, logistics, and electronics are creating new demand for lightweight and precision-oriented gloves.

The polyurethane protective gloves market is witnessing steady expansion driven by rising industrial safety awareness, ergonomic advancements, and growing industrialization across developing economies. While cost and material limitations remain challenges, innovations in design and sustainability are creating strong opportunities for future growth. PU gloves are expected to remain a preferred choice for industries requiring a balance between protection, precision, and comfort.

KEY INDUSTRY DEVELOPMENTS:

- April 2025: Radians, Inc., a personal protective equipment manufacturer, launched 14 new disposable gloves to meet the growing need for single-use gloves. These gloves help to safeguard people and products from contamination, chemicals, and injuries.

- November 2024: PIP Global announced that they have acquired Honeywell’s Personal Protective Equipment Business, including leading brands Fendall, Fibre-Metal, Howard Leight, KCL, Miller, Morning Pride, North, Oliver, Salisbury, UVEX, and others. This expansion will help the company expand its portfolio and enhance its geographic reach.

Comments

0 comment