views

Soda Ash Market Global Trends Influencing Industry Growth through 2032

The global soda ash market is experiencing robust growth, driven by increasing demand from key industries such as glass manufacturing, detergents, chemicals, and water treatment. Soda ash, also known as sodium carbonate (Na₂CO₃), is an essential raw material used in several industrial processes due to its strong alkalinity and versatile chemical properties.

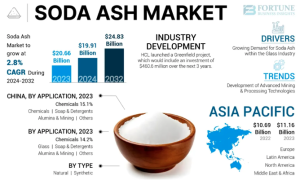

Market Size and Forecast

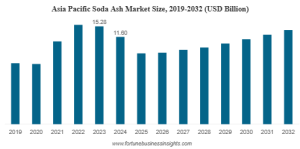

According to Fortune Business Insights, The global soda ash market size was valued at USD 18.74 billion in 2024. The market is projected to grow from USD 15.03 billion in 2025 to USD 23.39 billion by 2032, exhibiting a CAGR of 6.5% during the forecast period. Asia Pacific dominated the soda ash market with a market share of 61.89% in 2024.

The market expansion is primarily driven by rapid industrialization, rising infrastructure development, and increasing consumption of glass products across automotive, construction, and solar industries.

Key Takeaways

-

Market Value (2024): USD 18.74 billion

-

Market Value (2032): USD 23.39 billion

-

Growth Rate (CAGR): 6.5% (2025–2032)

-

Leading Region: Asia Pacific (61.89% share in 2024)

-

Major Drivers: Glass manufacturing, detergents, and solar glass demand

-

Emerging Trend: Transition to sustainable and energy-efficient production

Information Source: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/soda-ash-market-110681

Key Market Segments

By Type

-

Synthetic Soda Ash:

Synthetic soda ash accounted for the largest market share in 2024 owing to its consistent quality and wide applicability in glass manufacturing, detergents, and chemical synthesis. -

Natural Soda Ash:

The natural variant is gaining traction due to its lower energy requirement and reduced carbon emissions during production, aligning with sustainability goals.

By Product Type

-

Dense Soda Ash:

Dense soda ash dominated the market in 2024, driven by strong demand from the glass industry. It is preferred for its high bulk density, low dust content, and stability in manufacturing operations. -

Light Soda Ash:

Light soda ash is primarily used in detergent, chemical, and water treatment applications where fast dissolution is required.

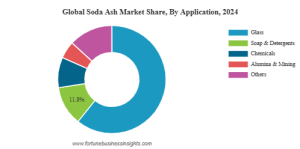

By Application

-

Glass Manufacturing: The largest segment, fueled by growing demand for flat, container, and solar glass.

-

Soaps and Detergents: Used as a water-softening and cleaning agent, particularly in household and industrial detergents.

-

Chemicals and Mining: Employed in the production of sodium silicates, bicarbonates, and alumina.

-

Water Treatment: Acts as a pH regulator and neutralizing agent for industrial and municipal water systems.

List of Key Soda Ash Companies Profiled

- Tata Chemicals Ltd. (India)

- Ciner Group (Turkey)

- NIRMA (India)

- Solvay (Belgium)

- DCW Ltd. (India)

- Shandong Haihua Group Co., Ltd. (China)

- Sudarshan Mineral (India)

- Şişecam (Turkey)

- Angel Chemicals Private Limited (India)

- Radhe Enterprise (India)

- InoChem (Saudi Arabia)

Regional Insights

The Asia Pacific region dominated the global soda ash market in 2024, accounting for approximately 61.89% of total market share. This dominance is attributed to strong glass and detergent production capacities in China and India, along with rapid infrastructure growth and urbanization.

North America and Europe are witnessing steady demand supported by industrial applications and the development of sustainable soda ash production technologies. Meanwhile, emerging economies in the Middle East, Africa, and Latin America present lucrative opportunities due to increasing construction and water treatment activities.

Market Trends and Developments

-

Shift Toward Sustainable Production:

Manufacturers are investing in green technologies and low-emission processes such as the e.Solvay process to minimize carbon footprints and improve energy efficiency. -

Technological Advancements:

Adoption of advanced mining techniques, real-time monitoring, and automation to optimize production and reduce operational costs. -

Rising Solar Glass Demand:

Rapid expansion of the solar energy sector is significantly increasing the consumption of high-purity soda ash used in solar glass manufacturing. -

Expansion in Emerging Markets:

Growing population, industrial development, and higher standards of living in Asia, Africa, and Latin America are boosting demand for detergents and consumer goods containing soda ash.

Challenges

-

Fluctuating Raw Material and Energy Costs:

Price volatility of key inputs such as limestone, salt, and energy resources can impact production economics. -

Environmental Regulations:

Stringent emission and waste disposal regulations are compelling producers to adopt cleaner technologies, leading to increased production costs. -

Market Price Pressure:

Oversupply in certain regions and intense competition among global producers can affect profitability.

The global soda ash market is set to continue expanding steadily through 2032, driven by high demand from glass and detergent industries and growing emphasis on sustainable production practices. The market’s transition toward low-carbon, energy-efficient processes will shape the competitive landscape in the coming years.

Companies focusing on cost efficiency, environmental sustainability, and technological innovation will gain a strong competitive edge. Furthermore, rising investments in renewable energy infrastructure, particularly solar power, will provide significant opportunities for market participants.

Information Source: https://www.fortunebusinessinsights.com/soda-ash-market-110681

KEY INDUSTRY DEVELOPMENTS

- December 2023: Solvay introduced a new soda ash production process named e.Solvay process. This new technology promises to cut CO₂ emissions by 50%, reduce energy, water, and salt consumption by 20%, and decrease limestone use and residues by 30%.

- June 2023: Tata Chemicals announced a USD 968.0 million capex plan, including a 380 KT salt capacity addition in the U.K. and Mithapur, India. This would boost its global salt capacity to 2.3 MT and India’s to 1.8 MT. The investments aimed to support growth, sustainability, and increased production across key product lines.

Comments

0 comment