views

Sulfur Market Growth Drivers, Challenges, and Industry Forecast 2032

Sulfur is an essential industrial element primarily used in the production of sulfuric acid, a key component in fertilizers, chemicals, and numerous manufacturing processes. The demand for sulfur is closely tied to global agricultural activity, industrial expansion, and refinery output. The sulfur market continues to grow steadily as nations prioritize food security and chemical production efficiency.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/sulfur-market-102143

LIST OF KEY COMPANIES PROFILED

- Suncor Energy Inc. (Canada)

- H.J. Baker & Bro., LLC (U.S.)

- Abu Dhabi National Oil Company (UAE)

- Marathon Petroleum Corporation (U.S.)

- Gazprom (Russia)

- Aramco Trading (ATC) (Saudi Arabia)

- Shell (Netherlands)

- Georgia Gulf Corporation (U.S.)

- Kuwait Petroleum Corporation (Kuwait)

- Petrobras (Brazil)

Regional Insights

The Asia Pacific region dominated the global sulfur market in 2023 with a 34.11% share. This leadership position is primarily due to the region’s expanding agricultural industry, growing demand for fertilizers, and the presence of large refining and chemical processing capacities.

-

United States: The U.S. sulfur market is projected to reach USD 941.0 million by 2032, driven by rising agricultural productivity, fertilizer demand, and advancements in sulfuric acid production.

-

China: China experienced a decline in sulfur imports in 2024, with import volumes dropping below 500,000 tons, the lowest May volume since 2004.

-

India: India’s sulfur market was impacted during the pandemic due to disruptions in trade and import logistics, though the country continues to represent a significant growth market driven by fertilizer demand.

Overall, Asia Pacific remains the largest and fastest-growing regional market, while North America and Europe maintain strong industrial demand supported by refinery production and chemical manufacturing.

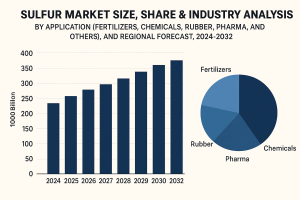

Market Segmentation by Application

According to Fortune Business Insights, the sulfur market is segmented by application into fertilizers, chemicals, rubber, pharmaceuticals, and others.

-

Fertilizers: The fertilizer segment holds the largest market share, accounting for over 50% of global sulfur demand. Sulfur is used extensively in producing sulfuric acid, which is vital for manufacturing phosphate fertilizers that support agricultural productivity.

-

Chemicals: Sulfur serves as a raw material in chemical processing, including the production of detergents, dyes, and solvents.

-

Rubber and Pharmaceuticals: Sulfur is used in vulcanizing rubber and synthesizing various pharmaceutical compounds, further enhancing its industrial relevance.

The dominance of the fertilizer segment underscores sulfur’s critical role in the global food supply chain and agricultural sustainability.

Key Market Drivers

-

Rising Fertilizer Demand

Agriculture remains the largest consumer of sulfur. Growing food demand, population expansion, and the need for high-yield crop production have significantly increased the use of sulfur-based fertilizers. -

Growth in Industrial Applications

Sulfur’s use in metal leaching, detergent manufacturing, and other industrial processes is driving demand from the chemical sector. -

Refinery and Byproduct Recovery

The majority of global sulfur production comes as a byproduct of oil and gas refining. Continuous refinery operations and improvements in sulfur recovery technologies have ensured a steady supply to meet industrial needs. -

Emerging Economies Driving Consumption

Developing countries such as India, China, and Brazil are witnessing increased sulfur consumption due to the expansion of fertilizer manufacturing and chemical production facilities. -

Global Trade Adjustments

Import and export trends play a significant role in sulfur market dynamics. China and India’s changing import volumes indicate the influence of logistics, refinery output, and domestic production capacities on global trade flows.

Challenges

Despite positive growth trends, the sulfur market faces several challenges:

-

Supply Chain Vulnerabilities: Because sulfur is primarily produced as a refinery byproduct, disruptions in oil and gas refining can affect sulfur supply levels.

-

Import Dependence: Many agricultural economies rely heavily on sulfur imports, making them susceptible to international price fluctuations and logistics disruptions.

-

Market Concentration: Heavy dependence on the fertilizer segment makes the sulfur market sensitive to agricultural policy changes and global crop demand fluctuations.

Future Outlook (2024–2032)

The sulfur market outlook remains positive, with steady growth expected through 2032. Rising agricultural output, growing demand for phosphate fertilizers, and industrial expansion in emerging economies will be key growth drivers.

-

The market is projected to grow at a CAGR of 3.6%, reaching USD 7.99 billion by 2032.

-

Asia Pacific is expected to retain its dominant share due to strong agricultural and industrial activity.

-

North America and Europe will maintain stable growth supported by refinery advancements and chemical sector investments.

The balance between rising demand and controlled supply will continue to influence sulfur prices and trade dynamics globally.

The global sulfur market is poised for consistent growth, fueled by its indispensable role in fertilizers, chemicals, and industrial manufacturing. Asia Pacific leads the market, supported by agricultural expansion and robust industrial demand. While supply chain dependencies and regulatory pressures remain challenges, ongoing technological improvements in sulfur recovery and the rising focus on sustainable fertilizer use present significant opportunities for market players.

With its essential function in global agriculture and chemical production, the sulfur market will remain a critical component of the industrial ecosystem through 2032.

Information Source: https://www.fortunebusinessinsights.com/sulfur-market-102143

KEY INDUSTRY DEVELOPMENTS

- August 2020 – In August 2020, Gazprom Export, a significant part of Gazprom, increased the volume of exports. The company supplied around 1.3 million tons to foreign consumers.

- September 2019 – Gazpromneft-Badra, a subsidiary of Gazprom Neft, began the shipping of granulated product from the Badra oilfield in Iraq.

Comments

0 comment