views

The Sustainable Finance Market refers to financial services that consider environmental, social, and governance (ESG) criteria when making investment decisions, with the aim of creating long-term value not just for investors, but also for society at large. This market integrates sustainability into traditional finance to support projects and initiatives that have positive environmental and social outcomes. It includes products like green bonds, ESG funds, sustainability-linked loans, and impact investments. Financial institutions and investors across the globe are increasingly aligning their capital with sustainable goals, in response to growing climate risks, social inequality, and demand for corporate transparency. The fundamental goal of sustainable finance is to steer global finance towards activities that support decarbonization, biodiversity protection, and inclusive development.

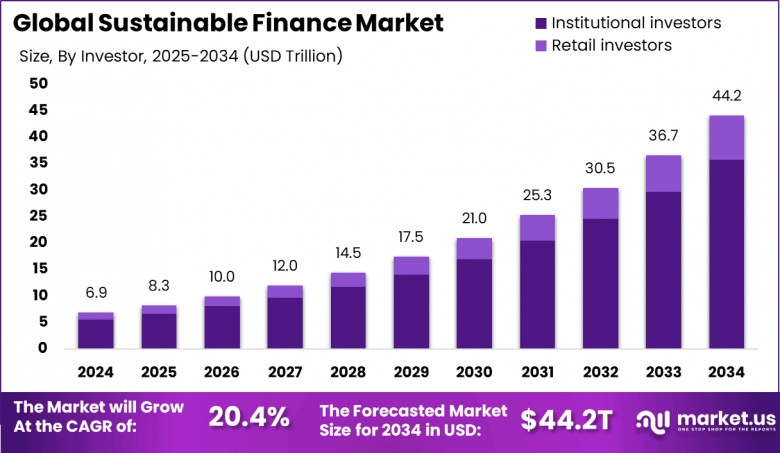

The Sustainable Finance Market is growing rapidly as the pressure mounts on governments, corporations, and institutions to act responsibly and transition to a greener economy. Investor appetite is increasing for funds and assets that meet ESG standards, and this shift is reflected in the consistent rise in ESG-related investments. The demand is particularly high among millennials and institutional investors who prioritize sustainability in their portfolios. Additionally, global initiatives like the UN’s Sustainable Development Goals (SDGs) and the Paris Agreement are influencing capital allocation decisions across public and private sectors. Companies that fail to adapt to these expectations risk reputational damage and loss of investor confidence, further fueling the shift in market dynamics.

One of the top driving forces behind this momentum is the urgent need to combat climate change, reduce carbon footprints, and promote social equity. There is also growing recognition that sustainable businesses often outperform their peers in the long run due to better risk management, innovation, and stakeholder trust. Financial institutions are increasingly embracing sustainable finance not just out of ethical obligation, but because it makes good business sense. Rising awareness among consumers and tighter ESG reporting requirements are compelling companies to adapt. The increasing frequency of climate-related disasters is another trigger accelerating sustainable finance as a defensive and proactive financial tool.

Comments

0 comment