views

Amid a new age of global hiring and remote work, companies can dip into talent pools from anywhere in the world— including India, a global leader in tech, finance and engineering.

However, while global expansion is exciting, it comes with exposure to compliance risks – one of the largest(and most overlooked) risks for all companies is Permanent Establishment (PE) Risk.

If you’re a company hiring or operating in India in a way that establishes a real and intimate connection between the business of non-residents with the activities performed in India to generate revenue for non-residents and the activities appears to be local and ongoing, the Indian tax authority (CBDT) may deem you to have created a PE—and that makes your company taxable under Indian law.

An Employer of record is the most suitable option for foreign firms hiring in India, since it takes care of compliance, payroll, benefits, and all HR related tasks. Moreover, it also ensures compliance and prevents the risk of Permanent Establishment (PE)

If your company is considered to have a Permanent Establishment in India, you could be subject to:

In many cases, simply hiring a full-time remote employee in India can trigger the risk - especially if they're involved in sales, client interactions, or technical delivery

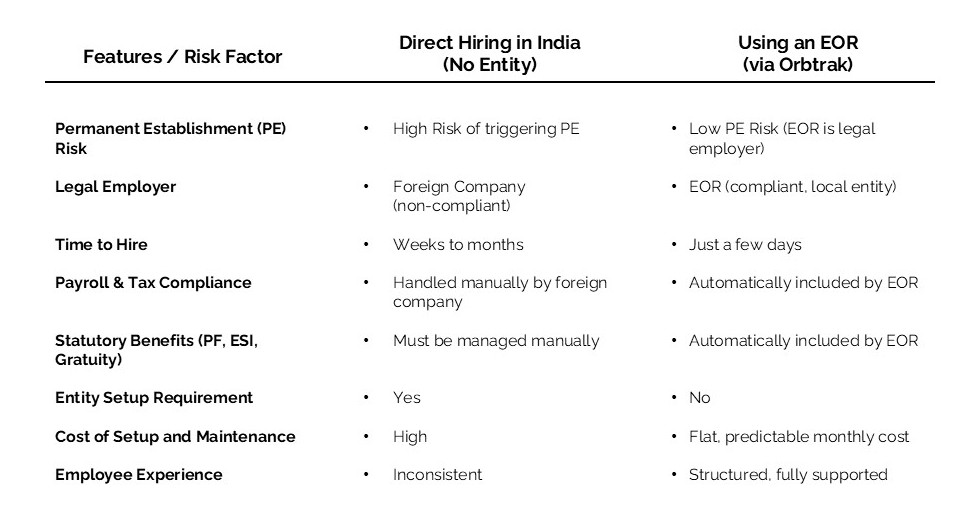

Comparison: Direct Hiring vs. Hiring via

Comments

0 comment