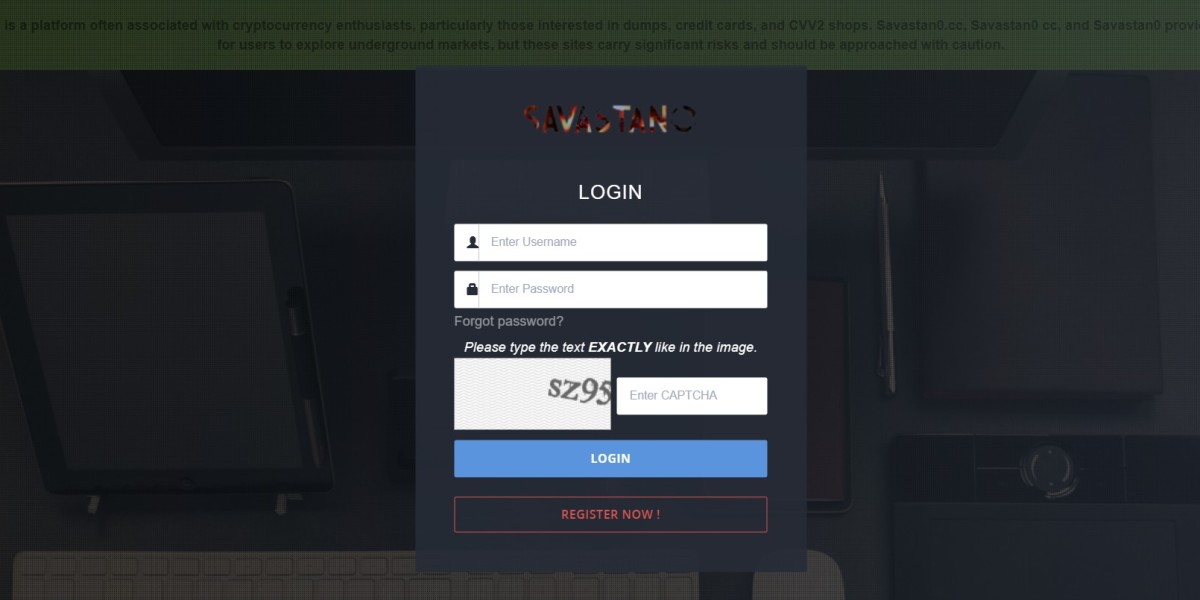

The financial landscape is rapidly evolving, and cryptocurrency is at the forefront of this transformation. Bitcoin, in particular, has gained immense popularity for its decentralized structure and global reach. One of the most innovative advancements within the cryptocurrency sphere is the introduction of Bitcoin automatic payment systems, which streamline the transaction process for businesses and consumers alike. Platforms like Savastan0.cc are leading this charge by offering seamless integration of Bitcoin payments, allowing for automation and efficiency in an increasingly digital economy.

In this article, we’ll explore the key advantages of using Bitcoin automatic payments, their impact on various industries, and the potential challenges businesses may face in adopting these systems.

What Is Bitcoin Automatic Payment?

Bitcoin automatic payment systems allow users to set up recurring transactions using Bitcoin without requiring manual intervention for each transaction. Once the payment schedule is set, Bitcoin is automatically transferred at regular intervals. This system benefits both businesses and consumers by simplifying recurring payments such as subscription fees, invoices, donations, and more.

Using decentralized blockchain technology, Bitcoin automatic payments eliminate the need for third-party financial institutions, providing enhanced security, lower fees, and faster transaction times. For businesses looking to stay competitive in the global market, integrating Bitcoin automatic payments can provide a significant edge.

Key Advantages of Bitcoin Automatic Payments for Businesses

1. Lower Transaction Fees

One of the most attractive features of using Bitcoin for automatic payments is the lower transaction costs. Traditional payment methods, especially those involving international transfers, can come with significant fees due to the involvement of multiple intermediaries, such as banks and payment processors. Bitcoin transactions bypass these intermediaries, significantly reducing the cost associated with cross-border payments.

For businesses with recurring transactions, such as subscription-based services, these lower fees can lead to substantial savings over time. By minimizing payment processing costs, businesses can allocate resources more efficiently, enhancing profitability.

2. Faster Transactions

Traditional financial transactions, particularly international payments, can take several days to process due to banking regulations and operational hours. In contrast, Bitcoin transactions are processed within minutes, regardless of geographic location. This is a crucial advantage for businesses that require timely payments to maintain cash flow.

Bitcoin automatic payments ensure that funds are transferred almost instantaneously, which is particularly beneficial for businesses dealing with clients or customers across different time zones. Faster payments mean better business operations, as businesses can quickly reinvest funds or pay employees and contractors without delays.

3. Global Reach Without Currency Conversion

Bitcoin is a global currency that operates without the need for currency conversion. Businesses that operate internationally often face challenges when dealing with multiple currencies and the associated exchange rate fluctuations. Bitcoin removes this barrier by allowing businesses to transact with clients or customers in any country without worrying about converting one currency to another.

This feature is especially valuable for e-commerce companies and freelance platforms, as it simplifies global transactions and provides more predictable financial outcomes. By using Bitcoin automatic payments, businesses can expand their global reach without the complications of managing multiple currencies.

4. Enhanced Security and Privacy

Bitcoin payments are secured by blockchain technology, which is renowned for its robustness and resistance to fraud. When using Bitcoin automatic payments, businesses can benefit from an added layer of security, as transactions are verified and recorded on a decentralized ledger, making them nearly impossible to alter or counterfeit.

Additionally, Bitcoin payments do not require sensitive financial information such as bank account numbers or credit card details, further protecting both businesses and consumers from potential data breaches or identity theft. With increasing concerns over online privacy, the enhanced security offered by Bitcoin payments is an attractive feature for businesses in industries such as e-commerce, where safeguarding customer data is paramount.

5. Automated and Efficient Payment Processes

Automation is at the heart of Bitcoin automatic payments. Businesses can set up recurring payment schedules, ensuring that transactions are processed on time without the need for manual intervention. This is particularly useful for subscription services, utility payments, and other recurring transactions, as it reduces the administrative burden on businesses.

For consumers, automation means they no longer need to worry about missing payments or manually initiating transfers. This convenience increases customer satisfaction, making Bitcoin automatic payments an excellent choice for businesses looking to improve their customer experience.

6. Reduced Risk of Chargebacks

One of the challenges businesses face with traditional payment methods is the risk of chargebacks, where customers can reverse a transaction after it has been completed. Chargebacks are common in credit card payments and can lead to significant financial losses for businesses, especially in industries such as retail and e-commerce.

Bitcoin transactions are irreversible once confirmed on the blockchain, eliminating the risk of chargebacks. This gives businesses more certainty and protection against fraudulent activities, improving overall cash flow management and reducing the financial risks associated with chargebacks.

Industries Benefiting from Bitcoin Automatic Payments

Bitcoin automatic payments are making a significant impact across a variety of industries. Here are some sectors that stand to benefit the most from this technology:

1. Subscription-Based Services

From streaming platforms to software-as-a-service (SaaS) providers, subscription-based models are becoming increasingly popular. Bitcoin automatic payments make it easier for businesses to collect recurring fees without having to manually process each payment cycle. Customers can set up a payment schedule, ensuring that their subscriptions are never interrupted.

2. E-Commerce

E-commerce platforms are prime candidates for adopting Bitcoin automatic payments. With global customers and frequent transactions, e-commerce businesses can benefit from the speed, lower fees, and security of Bitcoin payments. Automated payments reduce cart abandonment rates, streamline the checkout process, and foster greater customer loyalty.

3. Freelance Platforms

Freelancers and remote workers who deal with international clients can face delays and high fees when receiving payments through traditional banking systems. Bitcoin automatic payments solve these issues by providing a faster, more cost-effective solution for paying freelancers. The global accessibility of Bitcoin also ensures that freelancers can receive payments from anywhere in the world without currency conversion headaches.

4. Non-Profit Organizations

Non-profits and charities are increasingly turning to Bitcoin as a method for accepting donations. Bitcoin automatic payments allow supporters to set up recurring donations, helping organizations maintain a consistent flow of funds. Additionally, the lower transaction fees mean more of the donation goes directly to the cause rather than being eaten up by processing costs.

Challenges of Bitcoin Automatic Payments

While the advantages of Bitcoin automatic payments are clear, businesses should also be aware of some potential challenges associated with adopting this technology.

1. Volatility of Bitcoin

Bitcoin is known for its price volatility. Its value can fluctuate significantly over short periods, which can pose a challenge for businesses that want to use it for recurring payments. For instance, the amount of Bitcoin required to fulfill a monthly payment may change drastically from one month to the next, complicating financial planning.

Some businesses mitigate this issue by converting Bitcoin into stablecoins (cryptocurrencies pegged to a fiat currency) or by using services that automatically convert Bitcoin payments into local currency at the time of the transaction.

2. Regulatory Uncertainty

While Bitcoin is becoming more widely accepted, the regulatory landscape surrounding cryptocurrencies remains uncertain in many regions. Some countries have strict regulations or even outright bans on Bitcoin, which could limit the ability of businesses to use Bitcoin automatic payments. Staying compliant with local laws is essential for businesses considering this payment method.

3. Technical Complexity

Implementing Bitcoin automatic payment systems can require a certain level of technical knowledge and infrastructure. Businesses need to ensure that their systems are compatible with Bitcoin wallets and payment gateways, which may require specialized knowledge or third-party services. While platforms like Savastan0.cc simplify the process, smaller businesses may still face challenges during the initial setup.

The Future of Bitcoin Automatic Payments

As Bitcoin continues to gain mainstream acceptance, the use of automatic payments is likely to grow. With advancements in blockchain technology and increasing demand for decentralized payment solutions, Bitcoin automatic payments are poised to become a standard feature for businesses across industries.

Moreover, as more platforms and services integrate Bitcoin payments, businesses will have access to even more tools and resources to manage their transactions efficiently. Savastan0.cc, for instance, is helping lead the charge in this new era of digital payments, offering solutions that meet the evolving needs of modern businesses.

Conclusion

Bitcoin automatic payments offer numerous advantages for businesses, including lower transaction fees, faster payments, enhanced security, and global accessibility. While challenges such as volatility and regulatory uncertainty exist, the potential benefits make Bitcoin an increasingly attractive option for businesses looking to streamline their payment processes. As the digital economy continues to evolve, adopting Bitcoin automatic payments could give businesses the competitive edge they need to thrive in the global marketplace.