Introduction

Water is a fundamental resource for life and industry. As urbanization and industrialization rise, the demand for clean water and effective waste management continues to increase. The treatment of water and wastewater has become a global priority. Primary water and wastewater treatment is the initial phase of the treatment process. It focuses on the physical separation of large solids and particles from raw water or sewage. This stage is critical for preventing damage to downstream equipment and improving the efficiency of subsequent treatment processes.

The equipment used in this phase includes screens, grit removal systems, sedimentation tanks, clarifiers, and flow equalization systems. These systems remove suspended solids, grease, oil, and floating debris. The quality and efficiency of primary treatment directly affect the performance of secondary and tertiary treatment processes. Governments, municipalities, and industries worldwide are investing in upgrading their water infrastructure. These investments are driving demand for modern and efficient primary treatment equipment.

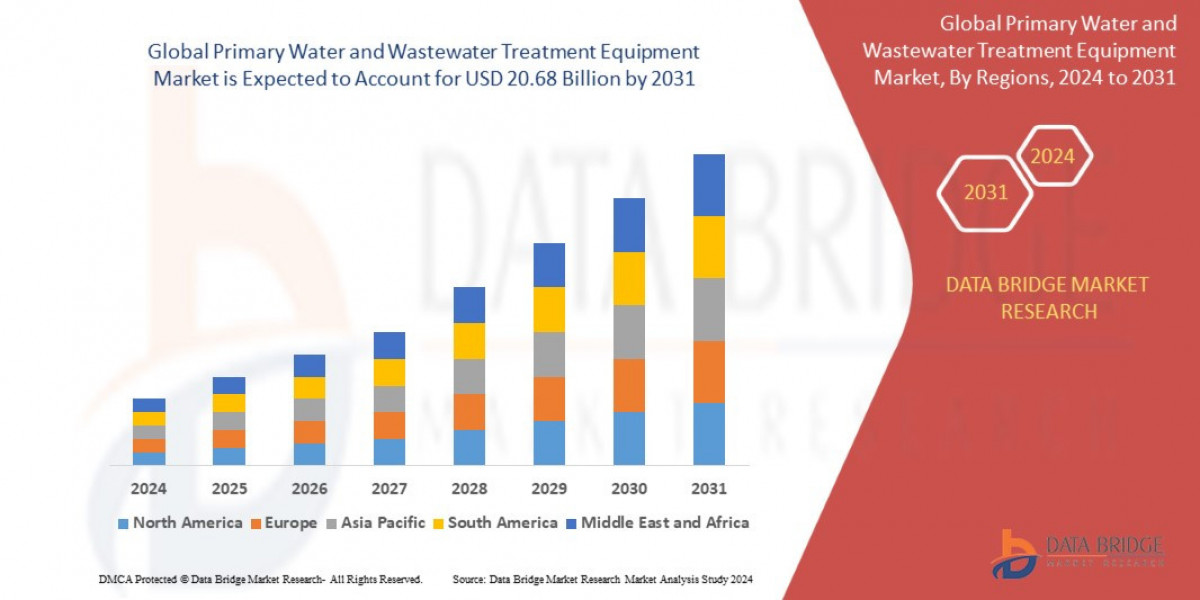

Market Size

Global primary water and wastewater treatment equipment market size was valued at USD 14.10 Billion in 2023 and is projected to reach USD 20.68 Billion by 2031, with a CAGR of 4.9% during the forecast period of 2024 to 2031.

For more information:

Market Trends

Technological innovation is a key trend in the primary treatment equipment market. Manufacturers are integrating automation, remote monitoring, and AI-driven systems to improve performance and reduce operational costs. Equipment is becoming more compact, energy-efficient, and easier to maintain. Modular treatment systems are gaining popularity, especially in remote or rapidly growing urban areas. These systems can be quickly deployed and scaled based on demand.

Another trend is the focus on sustainability. Equipment designers are incorporating materials and processes that reduce environmental impact. There's a growing emphasis on water reuse and resource recovery. Primary treatment systems are now being designed to facilitate the recovery of biosolids and energy from wastewater.

The adoption of Internet of Things (IoT) technology is also rising. Real-time data collection and predictive maintenance are helping operators increase uptime and reduce downtime. Smart water treatment systems are improving decision-making and optimizing resource use.

Market Share

The market is highly competitive, with several major players dominating global sales. Companies such as Veolia Environnement, SUEZ, Xylem Inc., Evoqua Water Technologies, and Ecolab are leading the industry. These players offer a wide range of treatment equipment and often provide integrated solutions covering the full water treatment lifecycle.

Veolia and SUEZ have a strong presence in Europe and expanding footprints in Asia and Africa. Xylem and Evoqua are prominent in the North American market. Local manufacturers in Asia-Pacific, such as Wabag and Thermax, are gaining market share by offering cost-effective solutions tailored to regional needs.

Strategic collaborations, mergers, and acquisitions are shaping the market landscape. Large firms are acquiring smaller technology-focused companies to enhance their product portfolios and expand into new geographic regions.

The Evolution

The evolution of primary water and wastewater treatment equipment has been marked by continuous innovation and adaptation. In the early stages, treatment plants relied on simple mechanical screens and settling tanks. These systems were labor-intensive and inefficient. With the rise of industrialization in the 20th century, treatment plants began to adopt mechanized and automated systems. Equipment became more durable, reliable, and capable of handling large volumes of waste.

Over the years, regulatory pressure pushed the industry to improve the efficiency and effectiveness of treatment equipment. This led to the development of advanced sedimentation systems, fine screening technologies, and grit chambers with better separation capabilities. The introduction of computational design and fluid dynamics modeling further optimized system performance.

In the past two decades, digital technology has revolutionized the industry. Sensors, software, and control systems have made treatment processes more intelligent and adaptive. Energy consumption and maintenance costs have decreased as a result. The focus is now shifting toward sustainable design, circular water use, and zero-liquid discharge solutions.

Market Trends (Expanded)

Urbanization is one of the most significant trends influencing the market. Rapid population growth in cities increases the volume of wastewater generated. This requires expansion and modernization of treatment infrastructure. Governments are implementing stricter environmental regulations. These regulations require industries and municipalities to upgrade their systems to meet discharge standards.

Climate change is impacting water availability and quality. As droughts and floods become more frequent, there's an increasing need for reliable and resilient treatment systems. Investments are being directed toward equipment that can operate efficiently under varying conditions.

Industrial water reuse is growing in sectors like power generation, food and beverage, textiles, and chemicals. These industries are investing in advanced primary treatment equipment to pre-treat their effluent for reuse or safe discharge. Decentralized treatment systems are also gaining traction. These systems allow communities and industries to treat water on-site, reducing reliance on centralized facilities.

Public-private partnerships (PPPs) are becoming common, especially in developing regions. These collaborations bring together government support and private sector efficiency to build and operate modern treatment facilities. International funding from development banks and environmental agencies is supporting these initiatives.

Factors Driving Growth

Several factors are contributing to the steady growth of the primary water and wastewater treatment equipment market. The most significant is the rise in global water scarcity. As freshwater resources become more strained, governments and industries are investing in treatment and reuse solutions.

Stringent environmental regulations are compelling organizations to treat wastewater before discharge. Regulatory compliance has become a major driver for equipment upgrades and replacements. Economic development in emerging markets is increasing demand for basic water and sanitation services. This is leading to significant investments in treatment infrastructure.

Technological advancements are reducing the cost of ownership and improving system performance. Innovations such as energy-efficient motors, automated controls, and self-cleaning filters are attracting more buyers. Public awareness of water pollution is rising. Communities are pushing for better treatment systems to protect public health and the environment.

The COVID-19 pandemic highlighted the importance of clean water and sanitation. It led to increased government spending on infrastructure, including water and wastewater projects. This momentum is expected to continue in the coming years.

Browse Trending Reports:

Extreme Pressure Additives Market

Anaesthesia Monitoring Devices Market

Low-Density Polyethylene (LDPE) Wax Market

Diabetic Food Market

Topical Keratolytics Market

Aircraft Ignition System Market

Woodworking Power Tools Market

Contact Center Analytics Market

Battery Recycling Market

Color Concentrates Market

Refinished Paint Market

Chatbot Market

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975