Have you ever opened your bank statement and noticed a small charge you didn’t expect? Maybe it was a monthly maintenance fee, a non-network ATM charge, or even an overdraft service fee that you weren’t fully aware of. These small fees may seem insignificant at first, but over time, they add up — silently eating away at your hard-earned money.

The worst part? Many of these charges are avoidable. The banking system is designed in a way that often benefits the institutions more than the individuals who trust them with their finances. But you don’t have to play by those rules anymore.

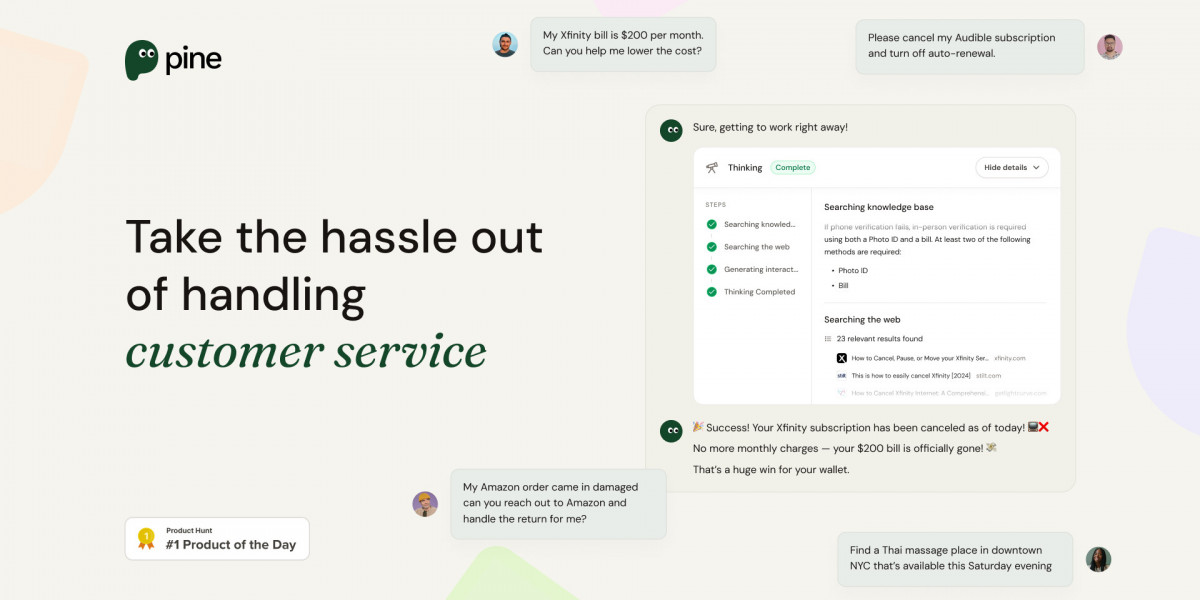

With PineAI, you can finally take back control of your finances. Pine’s intelligent, AI-powered assistant negotiates directly with your bank to help get these charges refunded and even works to prevent them from happening again. It’s simple, effective, and completely stress-free.

Why Do Banks Charge Monthly Fees?

To understand how Pine helps, it’s important to first understand why banks charge you at all. At their core, banks are businesses. And like any other business, they look for ways to increase revenue. One major stream of income for banks comes from the fees they collect from customers every month.

Here are some common reasons banks might charge you:

Failure to maintain a minimum balance in your account

Using ATMs outside of the bank’s preferred network

Requesting overdraft protection or going over your available balance

Receiving paper statements instead of digital ones

Accessing reward programs, cashback offers, or “premium” perks

While some of these services might sound helpful, many people are automatically enrolled or are unaware of the terms and conditions that come with them. This results in fees that feel hidden or unfair — and most people don’t know they can do anything about it.

How Pine Helps You Avoid Paying Unnecessary Fees

Traditionally, avoiding monthly maintenance fees involves jumping through hoops like:

Keeping a high minimum balance

Making multiple debit card purchases each month

Setting up direct deposit with specific employers

Manually contacting customer service to ask for fee waivers

While these tactics can work, they require effort, attention, and time — something most people don’t have in today’s busy world. That’s where Pine changes everything.

Pine’s AI-powered system does all the heavy lifting for you. It monitors your accounts, identifies any excessive or unjustified fees, and then automatically contacts your bank to negotiate a refund. No forms, no long phone calls, no arguing with customer service — just results.

Effortless Refunds, Maximum Savings

What makes Pine stand out from other financial apps is its hands-off approach. Once you sign up and connect your account, Pine starts working in the background. It scans your transaction history, spots irregular charges, and gets to work — all without needing your constant input.

Here’s what you can expect:

Automatic fee detection and refund requests

24/7 account monitoring for new or recurring charges

Personalized reports showing how much you’ve saved

Protection from future bank fees

Whether you’re a student, a freelancer, a full-time employee, or a retiree — Pine is built for people who want more control with less effort.

Peace of Mind, Without the Stress

Dealing with banks isn’t always easy. Between long wait times, complicated policies, and confusing financial jargon, it’s no wonder most people avoid disputing fees altogether. That’s exactly why Pine was created — to simplify the process and give people back the power to manage their finances without the stress.

You don’t need to be a financial expert. You don’t even need to know how the system works. Pine does it for you — clearly, efficiently, and with your best interest at heart.

Real Results for Real People

Pine isn’t just an idea. It’s a proven solution that’s already saved users hundreds of dollars in unnecessary charges. Users have reported getting back fees they didn’t even know they were paying. From maintenance charges to surprise overdraft fees, Pine has helped people reclaim their money — and their peace of mind.

And unlike many other financial tools, Pine focuses on action, not just tracking. It doesn't just show you where your money went — it actually helps you get it back.

Take Back What’s Yours

If you’re tired of watching your account balance shrink for no good reason, it’s time to make a change.

No more being at the mercy of hidden fees. No more dealing with frustrating customer service calls. No more money wasted on services you don’t need or want.

Let Pine work for you. Get started today, and take the first step toward financial freedom.