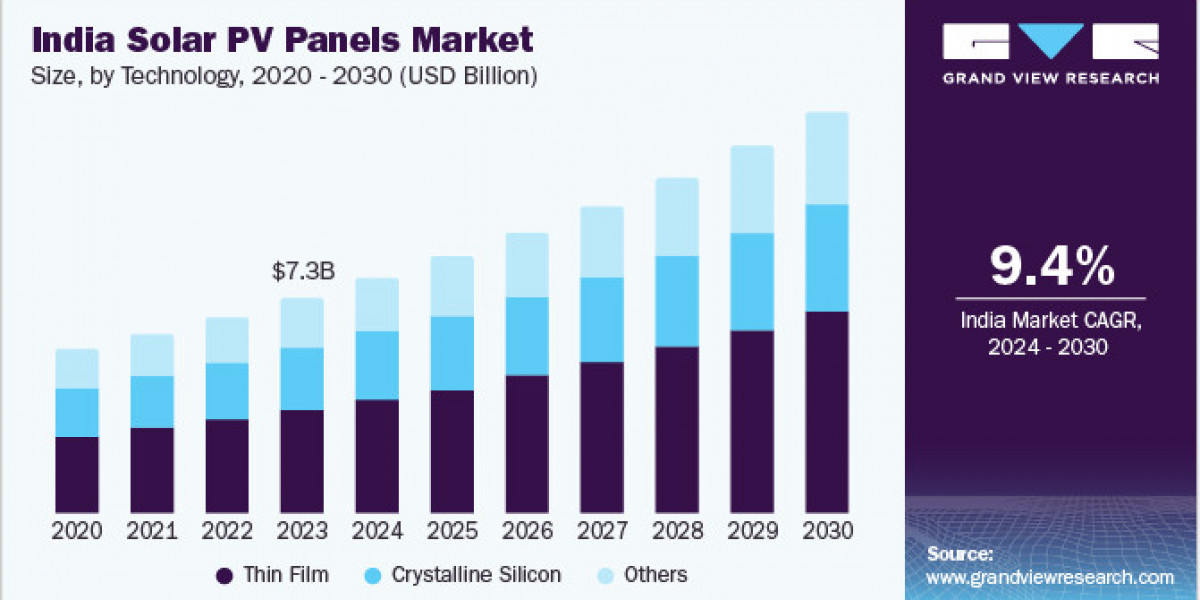

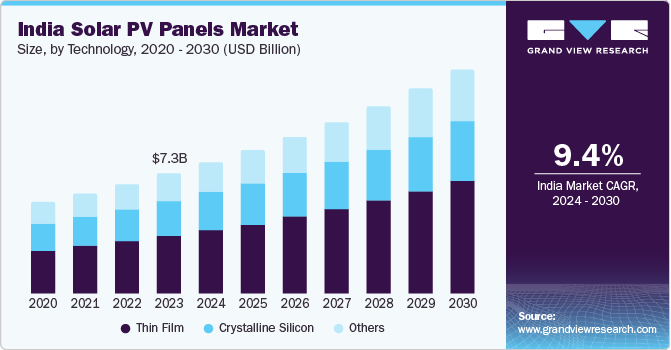

India's sun-kissed landscapes are becoming fertile grounds for a green energy revolution. In 2023, the India solar PV panels market, valued at USD 7.31 billion, is blazing a trail towards a projected 9.4% CAGR from 2024 to 2030. This significant growth is being powered by a potent combination of factors. Supportive government policies, like the Jawaharlal Nehru National Solar Mission (JNNSM) and various state-level initiatives, are providing a strong tailwind. Simultaneously, the decreasing cost of solar panels, a result of technological ingenuity and economies of scale, is making solar power an increasingly attractive and affordable option.

Furthermore, India's rising energy demands, fueled by a growing population and economic development, are creating a vast opportunity for solar PV as a clean energy source. The global imperative to combat climate change and air pollution is also driving a decisive shift towards renewables. Continuous technological progress is enhancing solar panel efficiency and grid integration solutions, making solar power a more reliable and effective choice. Adding to this momentum, a growing number of businesses are embracing solar power to meet their sustainability targets and enhance their brand image.

Government initiatives like JNNSM are actively promoting solar energy adoption through subsidies, tax benefits, and various incentives. JNNSM, for instance, facilitates the pre-registration of solar power projects, demonstrating the government's commitment to scaling up solar capacity.

The decreasing cost of solar panels is a game-changer. Driven by technological advancements and increased competition, solar power is now economically competitive with, and often cheaper than, fossil fuels. The Levelized Cost of Electricity (LCOE) for solar in India is a testament to this achievement. Solar module prices have plummeted by 82-85% in the last fifteen years, contributing to a dramatic reduction in solar power tariffs.

Get a preview of the latest developments in the India Solar PV Panels Market; Download your FREE sample PDF copy today and explore key data and trends

India's burgeoning population and expanding economy are creating an ever-increasing demand for electricity, a need that solar PV is ideally positioned to meet as a sustainable energy source. Concerns about climate change and air pollution are further emphasizing the importance of transitioning to cleaner energy options. Solar power also enhances India's energy security by reducing its reliance on volatile fossil fuel markets and geopolitical tensions. Solar PV systems are also bringing power to remote and off-grid areas where traditional electricity infrastructure is either absent or economically unviable. Ongoing advancements in solar panel efficiency, energy storage, and grid integration are continuously improving the performance and reliability of solar PV systems, further propelling market growth.

Businesses across India are increasingly adopting solar power as a core component of their sustainability strategies. For example, IKEA India's installation of a 10KW solar-powered system at a government school in Bengaluru exemplifies the growing corporate commitment to renewable energy and community well-being.

Detailed Segmentation

Technology Insights

The thin film segment dominated the market and accounted for a share of48.32% in 2023 and is also expected to grow at the fastest CAGR over the forecast period. This can be attributed to several drivers, including its cost-effectiveness, flexibility, and efficiency. Thin film technology offers a lower cost per watt compared to traditional crystalline silicon panels, making it an attractive option for large-scale solar projects in India.

Grid Insights

On Grid segment accounted for the largest revenue share in 2023. It is due to state policy incentives, financial considerations, cost reductions, and government support and incentives. It all works together to promote the growth of commercial solar PV capacity by creating a favorable environment for solar energy integration into the grid, making it more accessible and economically viable for businesses and industries. In January 2024, Prime Minister Narendra Modi unveiled Lakshadweep's inaugural grid-connected solar initiative, showcasing a cutting-edge Battery Energy Storage System (BESS) developed by SECI. This project encompasses Kavaratti and Agatti islands, with a total solar capacity of 1.7 MW and a 1.4 MWh battery storage facility situated in Kavaratti.

Application Insights

Industrial segment dominated the market in 2023. The rise in the industrial segment's involvement in the solar panel market is propelled by factors such as the advancement of photovoltaic power distribution systems improving industrial competitiveness, the dynamic nature of solar module prices affected by market demand, and the declining profitability of module manufacturers resulting in price reductions. Furthermore, the price fluctuations of silver, an essential component in solar modules, drive the demand for solar panel installations and contribute to the growth of the solar energy industry. For instance, in April 2023, Avaada Group raised USD 1.07 billion for green hydrogen and green ammonia ventures in India, with investments from Brookfield and GPSC, aligning with their global energy transition strategy and expansion into solar PV manufacturing.

Key India Solar PV Panels Company Insights

Some of the key companies in the India solar PV panels market include Tata Power Solar, Adani Solar, Vikram Solar, Waaree Energies, Saatvik Green Energy, RenewSys, Loom Solar, Goldi Solar.

- Tata Power Solar offers a range of solar products and services, including solar modules, solar rooftops, solar panels, solar pumps, solar water heaters, solar power systems for residential, commercial, and industrial applications, as well as innovative solutions such as solar trees, solar power shades, and solar balconies.

- Adani Solar is a leading solar panel manufacturer in India, known for high-quality mono and bifacial modules using PERC technology. With a 4 GW capacity and plans for a 10 GW ecosystem, they prioritize sustainability and innovation in the solar industry.

Key India Solar PV Panels Companies:

The following are the leading companies in the India Solar PV Panels market. These companies collectively hold the largest market share and dictate industry trends.

- Tata Power Solar Systems Ltd.

- Adani Group

- VIKRAM SOLAR LTD.

- Waaree Energies Ltd.

- Saatvik Green Energy Pvt Ltd.

- RenewSys India Pvt. Ltd.

- LOOM SOLAR PVT. LTD.

- Goldi Solar, Inc.

- Servotech Power Systems

- Bluebird Solar

- SWELECT Energy systems Ltd

- Panasonic Solar

- JA SOLAR Technology Co., Ltd.

- Microtek Solar Solutions

- Luminous India

India Solar PV Panels Market Segmentation

Grand View Research has segmented the India solar PV panels market on the basis of technology, grid, and application:

India Solar PV Panels Technology Outlook (Revenue, USD Billion, 2018 - 2030)

- Thin Film

- Crystalline Silicon

- Others

India Solar PV Panels Grid Outlook (Revenue, USD Billion, 2018 - 2030)

- On Grid

- Off Grid

India Solar PV Panels Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Industrial

- Commercial

Curious about the India Solar PV Panels Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In March 2024, BluPine Energy, a renewable energy company backed by Actis, acquired 369 MW of solar assets from the Acme Group, expanding its total renewable capacity to 2.4 GW in India. This acquisition demonstrates BluPine Energy's commitment to fostering a sustainable future through renewable energy solutions in India.

- In February 2024, Avaada Energy acquired 1400 MWp of solar projects in India through tenders issued by central and state government agencies, marking a significant advancement in the country's renewable energy sector.

- In February 2024, Epsilon Advanced Materials acquired a lithium-ion phosphate (LFP) cathode technology center in Germany, positioning India as a key player in LFP cathode manufacturing outside of China. This acquisition strengthens Epsilon's position in the market by enabling comprehensive solutions through the integration of cathode and anode materials for lithium-ion batteries.