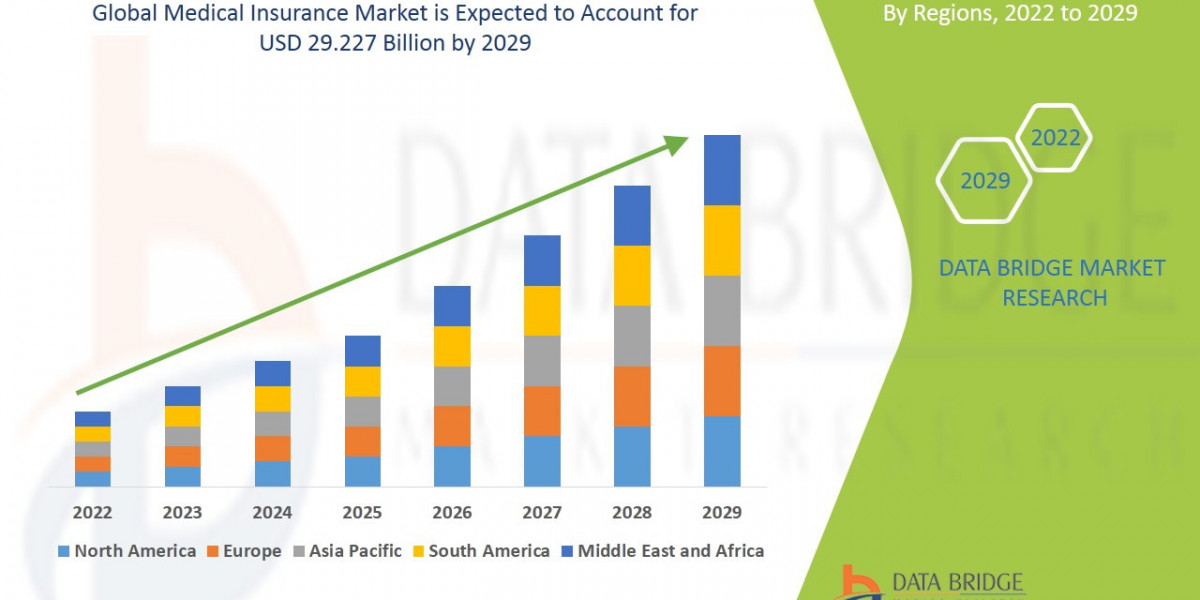

The Medical Insurance Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2029. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-medical-insurance-market

Which are the top companies operating in the Medical Insurance Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Medical Insurance Market report provides the information of the Top Companies in Medical Insurance Market in the market their business strategy, financial situation etc.

Unitedhealth Group, Anthem Insurance Companies, Inc., Aetna Inc., Centene Corporation, Cigna, Allianz Care, Axa, Assicurazioni Generali S.P.A., Bupa, AIA Group Limited, Aviva, BMI Healthcare, Broadstone Corporate Benefits Limited, HBF Health Limited, Healthcare International Global Network Ltd., International Medical Group, Inc., Mapfre, Now Health International, Oracle, VHI Group and Vitality Corporate Services Limited

Report Scope and Market Segmentation

Which are the driving factors of the Medical Insurance Market?

The driving factors of the Medical Insurance Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Medical Insurance Market - Competitive and Segmentation Analysis:

**Segments**

- Based on type, the medical insurance market can be segmented into health insurance, critical illness insurance, income protection insurance, and others. The health insurance segment is expected to dominate the market due to the rising healthcare costs worldwide and the increasing awareness among individuals about the importance of having health coverage. Critical illness insurance is also expected to witness significant growth as more people recognize the need for financial protection in case of a serious medical condition. Income protection insurance is forecasted to experience steady growth as individuals seek ways to safeguard their earnings in case of disability or illness.

- By coverage, the medical insurance market can be classified into individual coverage and family coverage. Individual coverage is projected to be the larger segment as more individuals are opting for personal health insurance plans to meet their specific needs and preferences. Family coverage is also expected to grow as families prioritize the health and well-being of all members by opting for comprehensive insurance policies that offer coverage for the entire family unit.

**Market Players**

- Some of the key players in the global medical insurance market include UnitedHealth Group, Anthem Insurance Companies, Inc., Allianz Care, Aetna Inc., Cigna, Aviva, AIA Group Limited, AIG, AXA, and Zurich Insurance Group. These players are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to strengthen their market position and expand their customer base. With the increasing demand for medical insurance and the evolving regulatory landscape, these market players are adapting their offerings to meet the changing needs of consumers and capitalize on emerging opportunities in the market.

https://www.databridgemarketresearch.com/reports/global-medical-insurance-marketThe global medical insurance market is experiencing significant growth driven by various factors such as increasing healthcare costs, rising awareness about the importance of health coverage, and the growing need for financial protection against critical illnesses. The market segmentation based on types reveals a diverse landscape with segments like health insurance, critical illness insurance, and income protection insurance playing crucial roles in meeting the insurance needs of individuals worldwide. Health insurance is poised to dominate the market due to the escalating healthcare expenses globally, prompting individuals to seek adequate coverage for medical treatments. Critical illness insurance is also gaining traction as more people recognize the financial risks associated with severe health conditions, driving the demand for policies that provide protection in such situations. Income protection insurance, on the other hand, is witnessing steady growth as individuals prioritize safeguarding their earnings in the event of disability or illness, highlighting the importance of comprehensive insurance coverage that extends beyond traditional health benefits.

In terms of coverage, the medical insurance market is divided into individual and family coverage categories, each catering to distinct consumer needs and preferences. Individual coverage is expected to maintain its lead in the market as more individuals opt for personalized health insurance plans tailored to their specific requirements. The flexibility and customizability of individual coverage options appeal to consumers seeking comprehensive yet personalized insurance solutions. Family coverage, on the other hand, is also on the rise as families prioritize the health and well-being of all family members by opting for inclusive insurance policies that offer coverage for the entire household. The emphasis on preventive healthcare and holistic coverage for families is driving the growth of family coverage options in the medical insurance market, reflecting the evolving needs and priorities of consumers in today's healthcare landscape.

Key players in the global medical insurance market, such as UnitedHealth Group, Anthem Insurance Companies, Inc., and Allianz Care, are actively engaging in strategic initiatives to bolster their market presence and cater to the evolving demands of consumers. Mergers and acquisitions, partnerships, and product innovations are among the key strategies adopted by market players to enhance their competitive capabilities and expand their**Market Players**

- UnitedHealth Group

- Anthem Insurance Companies, Inc.

- Aetna Inc.

- Centene Corporation

- Cigna

- Allianz Care

- Axa

- Assicurazioni Generali S.P.A.

- Bupa

- AIA Group Limited

- Aviva

- BMI Healthcare

- Broadstone Corporate Benefits Limited

- HBF Health Limited

- Healthcare International Global Network Ltd.

- International Medical Group, Inc.

- Mapfre

- Now Health International

- Oracle

- VHI Group

- Vitality Corporate Services Limited

The global medical insurance market is witnessing robust growth driven by escalating healthcare costs, increasing awareness of health coverage benefits, and a growing demand for protection against critical illnesses. The market segmentation based on types delineates a landscape with health insurance, critical illness insurance, and income protection insurance as pivotal segments meeting diverse insurance needs globally. Health insurance is poised to dominate the market due to the rise in healthcare expenditures, propelling individuals to seek robust coverage for medical treatments. Critical illness insurance is gaining traction as individuals acknowledge the financial risks of severe health conditions, leading to a surge in the demand for policies providing protection in such scenarios. Income protection insurance is experiencing steady growth as individuals prioritize safeguarding their earnings in the face of disability or illness, underscoring the importance of comprehensive insurance coverage beyond traditional health benefits.

Regarding coverage, individual and family coverage categories cater to distinct consumer needs and preferences within the medical insurance market

Explore Further Details about This Research Medical Insurance Market Report https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Medical Insurance Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Medical Insurance Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Medical Insurance Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2029) of the following regions are covered in Chapters

The countries covered in the Medical Insurance Market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of the Middle East and Africa.

Key Questions Answered:

1. What is the Medical Insurance Market?

2. How big is the Medical Insurance Market?

3. What is the growth rate of the Medical Insurance Market?

4. What are the key drivers of the Medical Insurance Market?

5. Which region dominates the Medical Insurance Market?

6. Who are the major players in the Medical Insurance Market?

7. What segments are included in the Medical Insurance Market?

8. What are the challenges facing the Medical Insurance Market?

9. What is the future outlook for the Medical Insurance Market?

10. How can companies benefit from the Medical Insurance Market?

Browse More Reports:

Vital Signs Monitoring Market – Industry Trends and Forecast

Cardiac Monitoring and Cardiac Rhythm Management Devices Market – Industry Trends and Forecast

Human Insulin Drugs and Delivery Devices Market – Industry Trends and Forecast

Leukemia Therapeutics Market – Industry Trends and Forecast

Autologous Stem Cell and Non-Stem Cell Based Therapies Market – Industry Trends and Forecast

North America Spinal Implants Market – Industry Trends and Forecast

North America Home Healthcare Market – Industry Trends and Forecast

North America Anti-Snoring Devices and Snoring Surgery Market – Industry Trends and Forecast

North America Orthodontic Supplies Market – Industry Trends and Forecast

North America Intraoperative Imaging Market – Industry Trends and Forecast

North America Biosurgery Market - Industry Trends and Forecast

North America Interventional Cardiology and Peripheral Vascular Devices Market – Industry Trends and Forecast

North America Transplant Diagnostics Market – Industry Trends and Forecast

North America Drug Screening Market – Industry Trends and Forecast

North America Blood Screening Market – Industry Trends and Forecast

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 978